The Stablecoin Revolution

Why Stablecoins are set to become the largest owner of US Treasuries by 2028.

I want to thank Fred Ehrsam, Co-founder of Coinbase and Paradigm, for honoring this piece with $1,000 - it was a pleasure to follow your call for research. I also want to thank everybody who supported me with comments and insights along the way. A special shoutout to Tze Donn from Tioga Capital, Kole Lee from the Stanford Blockchain Club, and the Areta team.

Foreword

USD-backed Stablecoins have been on a meteoric rise since the founding of Tether in 2014. Ten years later, the total Stablecoin market Cap stands at 145 billion, and the industry is creating unprecedented profits. Tether is by far the largest player in the Stablecoin Finance Ecosystem, with its stablecoin USDT maintaining a 70% market dominance. In Q4 2023, Tether made $2.85b in profit, which puts them on a $11.4b annual rate of profit. Remarkably, this profit was achieved with only approximately 60 employees. “[…] Even if Tether has 100 employees, then the company would be doing more than $100 million per employee in profit. That is the craziest statistic I have ever heard in business.” – Antony Pompliano. (Source) The company is likely the world’s business with the highest profit per employee – with an enormous lead. To put these statistics into context: Tether made more money with ~60 employees than McDonald’s with ~150,000 employees. (Source) Based on some metrics, Tether is the best business in the world.

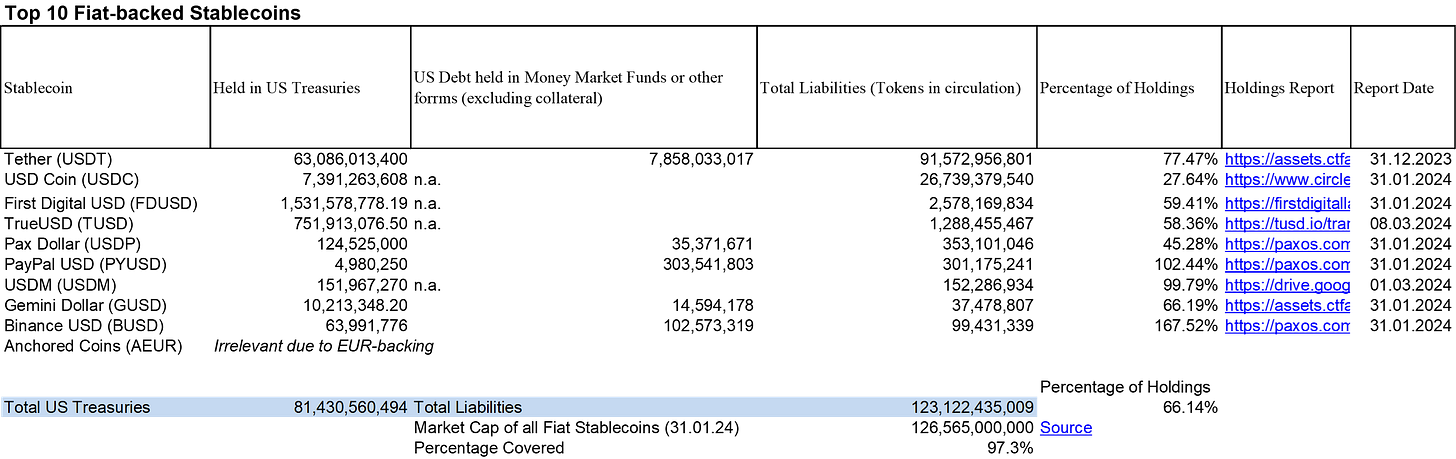

But Stablecoins go far beyond pushing new frontiers on the financial performance of companies. They are also set to have significant implications for the global financial system, which is already recognized by institutions like the Federal Reserve or EU Central Bank (Source, Source). USD Stablecoins dominate the market with a 98.9% share over all fiat currencies (Jan ’23) (Source). Most of the corresponding USD liabilities from the issuers are held in US treasuries. Today, stablecoins already are one of the largest holders of US Treasuries. According to my analysis of Transparency Reports from the leading Stablecoin Issuers, roughly $82.7b of the $135.2b total market cap is held in US treasuries (as of 01/31/24). That’s 61.1% of the total holdings and ranks them the 21st largest holder of US Treasuries worldwide. Therefore, Stablecoins are not only spreading the dollar; they also are a critical sink for US Treasuries in times of declining foreign appetite for US debt.

And, despite the impressive growth, we might still be at the very beginning of the Stablecoin flywheel. Forecasts predict a rosy future for the stablecoin market cap growth. For instance, Bernstein, a premier sell-side research and brokerage firm, expects the Stablecoin market to grow to $2.8 trillion in the next five years. Analysts led by Gautam Chhugani wrote that they “expect major global financial and consumer platforms to issue co-branded stablecoins to power value-exchange on their platforms” (Source). Even more conservative scenarios could lead to stablecoins becoming the world's largest owners of US Treasuries.

This thesis was stated by Fred Ehrsam, the co-founder of Paradigm and Coinbase, in a recent post on Warpcast – calling for research on the one-layer deeper analysis to support or debunk that thesis. This article presents my analysis while also providing color on its assumptions and broader implications.

As this topic is highly complex and multifaceted, I cannot elaborate on everything in this post, which is focused on the analysis of stablecoins becoming the world’s largest holder of US Treasuries. While I briefly touch upon some assumptions of the analysis, more background on the impact of regulation, TradFi integration, and mass-adoption use cases will be provided in part deux, “To the Moon or Mars? Growth Factors for Stablecoin Finance.” The implications of the Stablecoin Revolution will deserve part trois, “How the Stablecoin Bull Case could change the World.”

Executive Summary

The Prediction and its Implications.

The more time I have spent researching and exploring the Stablecoin Finance space, the clearer my conclusion became: stablecoins are at an inflection point in terms of institutional adoption and regulatory clarity. The intersection with consumer platforms is set to benefit disproportionately from this trend and be the catalyst for future growth. US Treasury holdings of stablecoin issuers are likely to soar alongside stablecoins' growing adoption and market cap. They already are the 21st largest holder today…

I forecast Stablecoins to become the world’s largest owner of US Treasuries between 2028 and 2034.

The methodology that underpins this thesis is a rigorous, three-tiered approach that encompasses:

- An assessment of current stablecoin holdings in US Treasuries.

- The development of three distinct growth scenarios for stablecoin finance.

- The status quo and forecast of the world's largest US Treasury holders.

The treasuries forecast is based on the US federal debt forecast by the Congressional Budget Office and 2-year CAGRs of the 33 largest US Treasury holders. Stablecoin growth scenarios are based on predictions by Bernstein, a premier sell-side research and brokerage firm, the 3-year CAGR of Tether, and a “10x market cap within ten years” prognosis, which was prominently shared by Fred Ehrsam.

Crucially, the study is grounded in key assumptions regarding the constancy of foreign US Treasury holdings and the percentage of stablecoin market cap held in US Treasuries. Limitations and the assumptions underlying the scenarios are discussed in dedicated sections.

Not fired up yet? A Glimpse into Implications:

How the Stablecoin Bull Case could change the world.

Financial Inclusion: 1.13 billion adults will receive access to financial services. A staggering 1.7 billion adults remain unbanked, two-thirds of which (~1.13B) have access to a mobile phone and, consequently, the internet. Stablecoins can serve as a bridge into the financial system for these individuals.

Global Currency Competition: Users in developing countries will have a highly practical and functional alternative to local high-inflation, unstable currencies. More than a third of Latin American consumers already use stablecoins to make everyday purchases (Source).

Market Dynamics: Should stablecoins rise as primary holders of US debt, we may witness a paradigm shift in how governments finance deficits. We might see a novel buffer against the waning foreign appetite for US debt, potentially stabilizing interest rates in the process.

Policy and Regulation: Regulatory frameworks may evolve to address the nuances of the new financial order. Stablecoins enjoy more political support than crypto regulation. Multiple top-tier jurisdictions, including Singapore (Source), Hong Kong (Source), and Japan (Source), have launched pilot projects.

Open Innovation: Stablecoins are moving monetary innovation from the country level to the company level. The rise of stablecoins may catalyze innovation, driving the creation of new financial instruments and platforms. The race for entrepreneurs to build the best solutions is up!

Potential Kill Switch to Dollar Hegemony: According to JP Morgan CEO Jamie Dimon, mounting US debt will eventually spark a ‘rebellion’ in global markets (Source). Through the crypto open innovation ecosystem, developing new currencies and rolling them out globally will be more accessible than ever.

Global Power Structures: As stablecoins ascend as Treasury holders and as a globally mass-adopted form of payment, the geopolitical power dynamics hinging on debt and money flows could shift. The US is well-positioned but could lose out to more diffuse alternatives like gold/crypto-backing.

The New Flippening: The new Flippening narrative would be Stablecoins catching up to BTC. The duopoly of BTC and ETH might evolve into a Tripoly of BTC, ETH, and Stablecoins. Ethereum's programmability, Bitcoin's first-mover advantage, and stablecoins' price stability and practical utility.

The fat application in Web3: The “fat” protocols and “thin” applications thesis (read it here) already has cracks. For instance, Synthetix and GMX constantly raked more daily fees than the entire Bitcoin network. A 10x+ in stablecoin market cap would be the death stab for the theory.

A new Crypto narrative: Stablecoins could change crypto's public and regulatory perception, from the Casino on Mars (great read by Matt Huang, Co-founder of Paradigm and former Sequoia Partner) to a foundational pillar of digital finance. Stablecoins could be crypto’s first true “killer app.”

The Analysis

Why Stablecoins might become the largest owner of US Treasuries by 2028.

My analysis is based on a three-tiered approach that encompasses:

1. An assessment of current stablecoin holdings in US Treasuries.

2. The development of three distinct growth scenarios for the stablecoin ecosystem.

3. The status quo and forecast of the world's largest US Treasury holders.

The underpinnings of my analysis lie in a comprehensive dissection of existing growth forecasts and their accompanying narratives. It’s important to clarify that the core of this analysis did not venture into the creation of new growth scenarios for stablecoins or US Treasury holdings. Instead, it builds on established projections and the fundamental assumptions they are based upon.

The assumptions for the stablecoin growth scenarios and implications of the thesis are covered separately in the upcoming piece “To the Moon or Mars? Growth Factors for Stablecoin Finance.”

1. Assessment of Stablecoin US Treasury Holdings

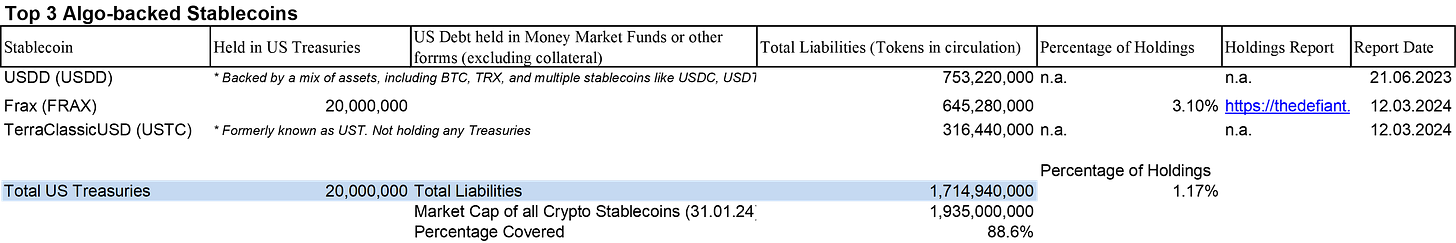

The stablecoin ecosystem is divided into three different genres (Fiat-backed, Crypto-backed, and Algorithmic) according to the DefiLlama classification. For each category, the transparency reports of the largest companies (by market cap) are examined, and the exact number of US treasury holdings is determined.

As of 01/31/2024, a minimum of $82.65b Stablecoin Funds are held in US-Treasuries.

Fiat Backed Stablecoins:

It is interesting to note that mountain protocol (USDM) is the second largest asset in the “directly US Treasury-backed” sector. Second only to Franklin Templeton's $331m OnChain US Government Bond Fund. Read more on the topic here.

Crypto-backed Stablecoins:

On the crypto-backed Stablecoin front, most Stablecoin issuers do not hold US Treasuries at the moment. However, it is interesting to observe that MakerDAO – the by far largest crypto-backed stablecoin issuer – holds ~26.7% of its holdings in US Treasuries. There is a case to argue that stablecoins have to expand their holdings beyond the crypto ecosystem to reach a certain scale. This is a separate thesis also to be discussed in part deux. In any case, ways to hold US treasuries in a crypto-native way are currently being developed. An example of where it is already being employed can be found when looking at algorithmic stablecoins.

Algo-backed Stablecoins:

The community behind Frax Finance, the multifaceted stablecoin protocol, has voted to deploy $20M of its collateral into US Treasuries.

Frax is leveraging an offering from Centrifuge, a company that has emerged as a leader in the real-world asset (RWA) space this year. The collateral backs Frax’s stablecoins, the most prominent of which is FRAX. Centrifuge Prime offers off-the-shelf solutions for DAOs looking to diversify their war chests, providing the technical, legal, and financial infrastructure for DAOs to invest in RWAs. The infrastructure for crypto-native stablecoin issuers to invest in US Treasuries and other RWAs is already here.

2. Stablecoin Growth Scenarios

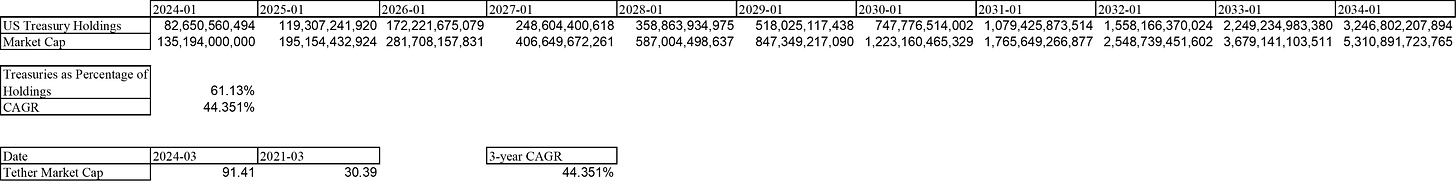

For the growth of the Stablecoin ecosystem three distinct scenarios were being considered. They include i) The 10x Market Cap Scenario, ii) The Bernstein Scenario (2.8T Market Cap in 2029), and iii) The Scenario that the ecosystem will grow by the 3-year CAGR of Tether.

All scenarios are subject to the assumption that the current state, with 61.13% of the total market cap held in US Treasuries, will be maintained. Additionally, each scenario is based on assumptions like legislation and adoption, which will be explored in part deux.

i) The 10x Scenario

The 10x Scenario forecasts that the total stablecoin market cap will grow by 1,000%. Prominent people believing in the feasibility of the prediction include the co-founder of Paradigm and Coinbase, Fred Ehrsam (Source), and Jose Fernandez da Ponte, who leads PayPal’s stablecoin endeavors and predicts the 10x to happen in the next five years (Source – Dec ’23). To map the scenario over ten years, I employed a constant CAGR of 25.9%.

ii) The Bernstein Scenario

The Bernstein Scenario is predicated on a bold projection that posits the stablecoin market cap could reach a staggering $2.8 trillion by the year 2028. It envisions a world where stablecoins are increasingly integrated into traditional finance systems, fulfilling roles in global trade settlements, remittances, and as a programmable layer for financial transactions.

iii) Tether Scenario

The Tether Scenario uses the 3-year historical Compound Annual Growth Rate (CAGR) of Tether, the largest stablecoin by market cap, as a basis for its forecast. This approach extrapolates past growth rates into the future, assuming that Tether's growth will be reflective of the broader industry.

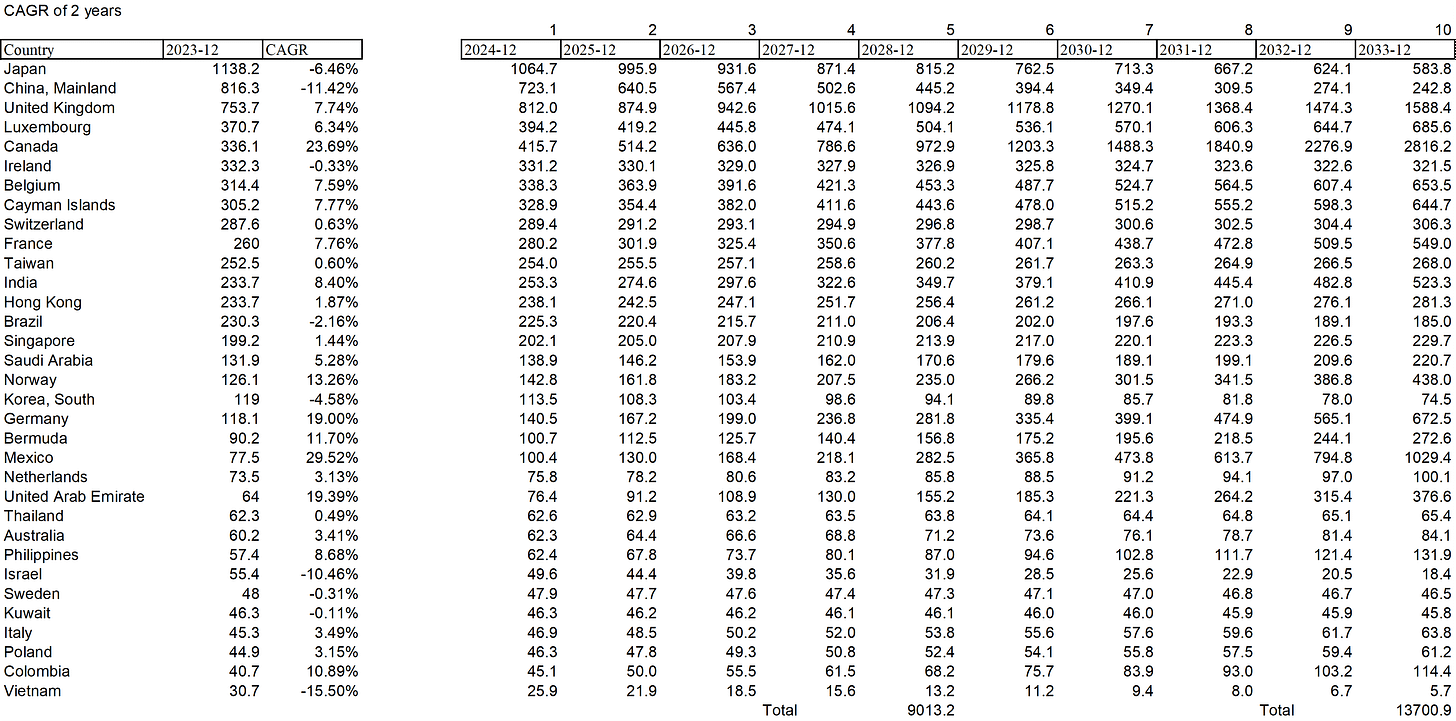

3. Status Quo and Forecast – Largest US Treasury holders

Status Quo

As of December 2023, the landscape of major foreign holders of US Treasuries is characterized by a familiar hierarchy of nations. Japan stands at the forefront as the dominant holder, followed by China and the UK, which maintain a significant, albeit lesser, share. The data was sourced from the following website.

In December 2023, Stablecoins were the 21st largest holder of US Treasuries.

US Treasuries Forecast

The forecast for the largest US Treasuries holders is derived through bottom-up and top-down methodologies. The bottom-up approach examines historical CAGRs to project future holdings, while the top-down method leverages reports from the Congressional Budget Office (CBO). This latter approach assumes that the proportion of US debt held by the leading entities will remain relatively unchanged. The predictions derived from this approach align closely with the observed 2-year CAGR from 2021 to 2023, which serves as the prediction for the further analysis.

In our assessment, we now integrate the projections from the stablecoin growth scenarios into the 2-year CAGR predictions for US Treasury holders. This exercise aims to understand when stablecoins, as an aggregated entity, might ascend to the position of the largest holder of US Treasuries.

Results

i) The 10x Scenario

Under the 10x Scenario, stablecoins' growth would lead it to become the 4th largest holder of US treasuries overtaking the current largest holders Japan and China. However, its holdings are projected to fall short of Canada, the United Kingdom, and Mexico, each boasting strong CAGRs over the coming years.

ii) The Bernstein Scenario

Outlined by the analysts at Bernstein, this scenario takes a bullish stance on the future of stablecoins, projecting their market cap to reach $2.8 trillion by 2029. It is the most ambitious of the three examined growth scenarios. In this scenario, stablecoins are projected to ascend the ranks of US Treasury holders, challenging and eventually surpassing the positions held by large sovereign nations – all within the next five years.

iii) The Tether Scenario

The Tether Scenario – like the Bernstein one – predicts Stablecoins to become the world’s largest holder of US Treasuries. Due to the comparatively (!) more conservative CAGR of 44%, it forecasts stablecoins to reach the largest holder status in 2033.

4. Limitations

The intricate nature of projecting financial growth and market behaviors is inherently fraught with complexities and uncertainties. This analysis carries limitations that must be acknowledged.

Current Holdings Analysis: The examination only covers 89% to 97% of the total market cap across stablecoin categories, hinting at possible underestimations. Reporting dates vary slightly among entities, introducing minor inconsistencies, yet the impact on the overarching analysis remains minimal.

Stablecoin Growth Scenarios: Crafting future scenarios necessitates simplifications, focusing on two variables: the market cap held in Treasuries and growth rates. While streamlining the analysis, this approach hinges on broad assumptions about legal frameworks, adoption rates, and other influential factors (discussed separately).

Treasuries - Data and CAGR Computation: The dataset includes only those countries consistently listed as top Treasury holders from 2019 to 2023. This selection may omit fluctuations in smaller holders but ensures relevance and practicability.

Forward-looking Projections: Utilizing CAGRs for future projections serves as a basic guide, yet it's not ideally suited for long-range forecasts. The analysis also assumes a constant percentage of debt held by top holders, a simplification that overlooks historical variability. The data on the debt holdings of single countries should not be seen as deterministic but rather as a useful approximation.

Cross-Scenario Analysis: Minor date discrepancies occur, primarily between December 31 and January 31 of subsequent years, due to variations in stablecoin and Treasury data availability. These inconsistencies are noted but do not significantly detract from the study's conclusions.

5. Final Thoughts

In concluding the exploration of stablecoins' trajectory towards becoming the predominant holders of US Treasuries, it's clear we stand on the brink of a transformative era in global finance.

The approach above simplifies a highly complex situation by making the forecast dependent on two single variables: the market cap held in Treasuries and CAGRs.

In my opinion, the assumption of the stablecoin market cap being held in treasuries remaining at roughly 61.13% in the short- to mid-term is a likely outcome.

The part with the widest deviations in expectations is the CAGR of the stablecoin market cap. A slight difference in CAGR will have enormous influence over extended periods of time. The projected CAGRs of 25.9% (10x), 44.6% (Tether 3-yr), and 83.3% (Bernstein) are extremely high and almost unheard of except for very few edge cases.

As a comparison, predictions for the CAGR of Global AI reach 40% (Source), while other innovative industries like 5G Security are expected to grow at a CAGR of 36.8% (Source).

Yet, many industry insiders believe we will hit those growth rates and potentially even exceed them. I personally agree with them. The Stablecoin Flywheel of regulatory support, institutional adoption, and mass-adoption use cases will take us there – in part deux of the stablecoin revolution I’ll discuss how.

The piece will include deep dives providing context to some of the most important questions in Stablecoin Finance: We’ll explore why the US government could kill Stablecoins at any time through Fed Master accounts and reasons they should or shouldn’t do. We’ll analyze when we will get JP Morgan Coin and see that it actually already exists. We’ll look at Ethena’s USDe, cryptos' latest stablecoin moonshot, and discuss why it will remain on the moon and not take us to Mars. We’ll also dive into the key dynamic for investing in the ecosystem and Cicle’s upcoming IPO. And much more…

As I jumped into the rabbit hole researching those topics, I was impressed seeing how many of my sources were only a few months, weeks, or even days old. The space is evolving at the speed of light.

Follow on X and subscribe to Substack to stay on top of the game!

Subscribe or Die!

PS: Please get in touch with me if you want to verify my calculations and try new scenarios. I’m happy to share the Excel file.