Stablecoin-powered Saving: Bridging into Open Finance

A three-step plan to upgrade the financial system.

Thanks to Kole Lee from the Stanford Blockchain Club, Charles Jansen and Chuck Mounts from S&P Global Crypto, Gordon Liau from Circle, Kilian Keßler, and the Areta team for their feedback and insights on this post.

As I think about DeFi and CeFi, my general conclusion is that DeFi is better in every aspect. It champions transparency, autonomy through non-custodial structures, inclusivity via permissionless access, seamless composability, and an inherently lower cost base. The real-time verification of solvency and transaction history, elimination of counterparty risk, open participation, and minimal overhead render DeFi a paradigm shift in financial operations.

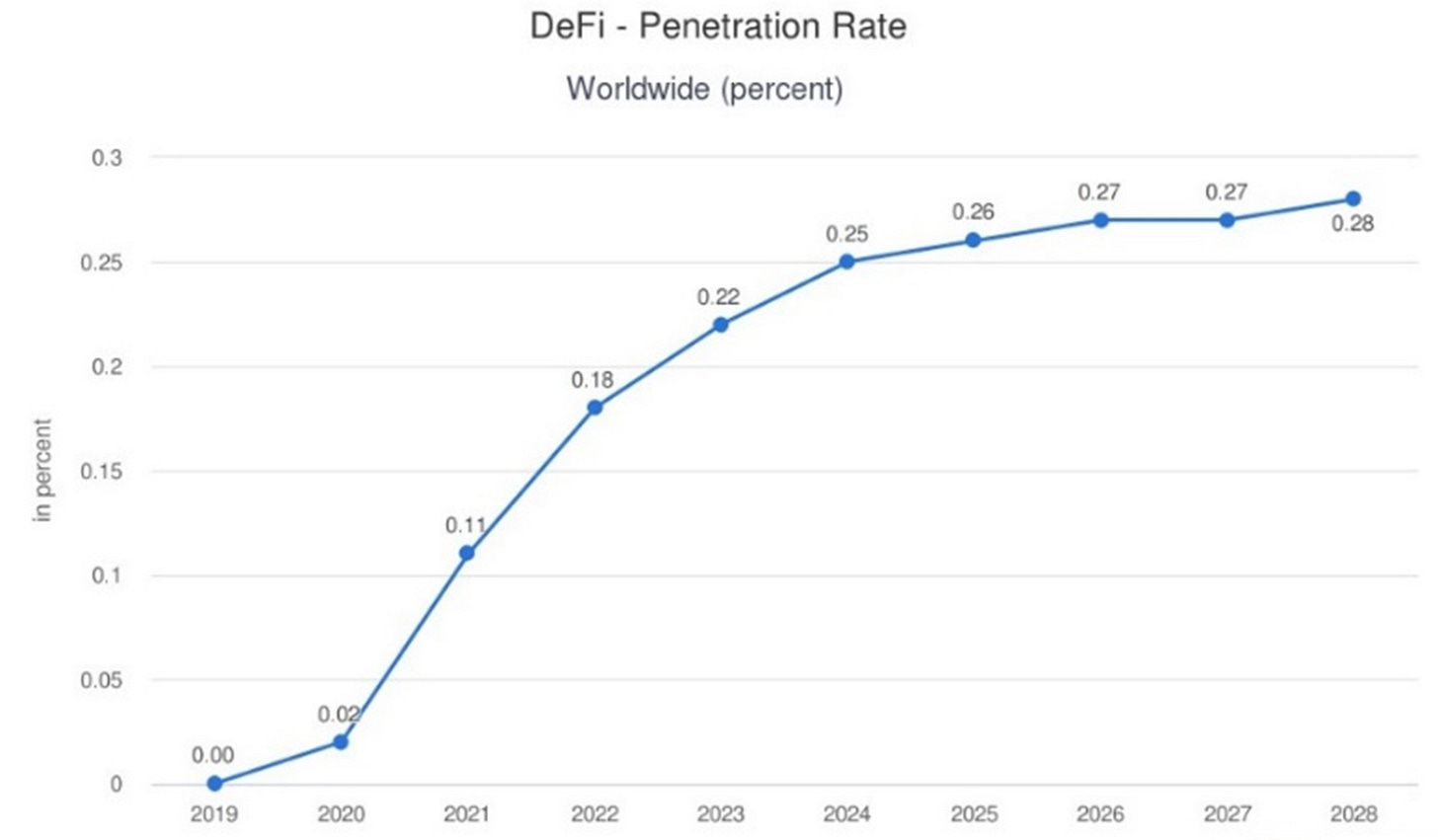

Despite its prowess, DeFi’s adoption curve reveals it as an outlier in the broader financial ecosystem. Today, DeFi only has $100 billion of total value locked and a 0.26 percent penetration rate. The friction between the incumbent TradFi system and the emergent DeFi platforms remains a significant barrier. What DeFi craves—and what users demand—is an evolution in user experience, simplification of processes, better TradFi integration, and regulatory frameworks conducive to growth.

This essay argues that we’ll see the iPhone moment of DeFi adoption through stablecoin-powered financial inclusion within the next two years. Billions of people in emerging markets would prefer saving in US Dollars over local fiat currencies – they’ll use Stablecoins for USD-denominated saving and yield generation. Thereby, stablecoins can serve as a bridge to the Open Finance ecosystem through stablecoin-first Neobanks and Neobrokers. Like many financial innovations over the past decades, the next era of finance is set to start in emerging markets, especially Latin America and Africa.

While the utility of stablecoins is generally agreed upon, the prevailing crypto narrative is that this cycle will be “one more infra-only cycle (again).” I argue that the infrastructure is already here for hundreds of millions of users saving in stablecoins. Stripe’s stablecoin integration marked the last in a series of game-changers pathing the way for stablecoin mass adoption.

Additionally, some of the brightest minds within the financial inclusion community, like Ben Kuhn, the former CTO of Wave, one of Africa's leading fintech platforms, have voiced concerns about Stablecoins as a killer app for financial inclusion. While his and other criticisms are valid, we’ll explain that crypto doesn’t need to solve the hard parts of financial inclusion and dive into the reasons why the timing is right now. In the end, we’ll explore opportunities to invest in line with the thesis - enter Next-gen Issuers, Stablecoin-first Neobanks, Payment Processors, and much more.

The implications of the thesis cannot be overstated. Ultimately, it is not about DeFi but Open Finance. Stablecoin-powered financial inclusion sets a roadmap for onboarding billions of people into the global financial system. For the first time, financial markets can be global, permissionless, and for many kinds of derivative contracts, without counterparty risk. Stablecoins will serve as the bridge to make it happen.

Cracking The Financial Exclusion Conundrum

According to the World Bank, about one-third of adults – 1.7 billion – are still unbanked. Yet, of this vast number, two-thirds - approximately 1.13 billion - have access to a mobile phone and the internet. This leads to an exciting outlook. Many of those people are set to be onboarded in the near future.

Countries like Kenya have set precedents with their mobile money revolutions. While only 42 percent of Kenyan adults had bank accounts in 2011, the latest World Bank Global Findex Report notes that the percentage has increased to an impressive 79 percent.

The proof-of-concept exists, technology is ready, and the race for entrepreneurs to onboard the unbanked across the world is up. Looking at Africa, mobile money is a multi-decade growth story in its early innings.

When aiming to build a world-changing company from scratch, it helps to build in a fast-growing market. In some exceptional cases, market growth compounds through multiple simultaneous step-function improvements. Financial inclusion through mobile money in Sub-Saharan Africa and other emerging markets is such an extraordinary case pushing the idea of simultaneous market growth drivers to its limits. These include

Rapid Population Growth

Steady increases in internet and mobile phone penetration rates

A growing share of the population rising into the middle class

Increasing preference for digital transactions

Expansion of mobile money offerings

One or two durable growth-driving trends are great – a market with 5+ compounding growth factors is incredible.

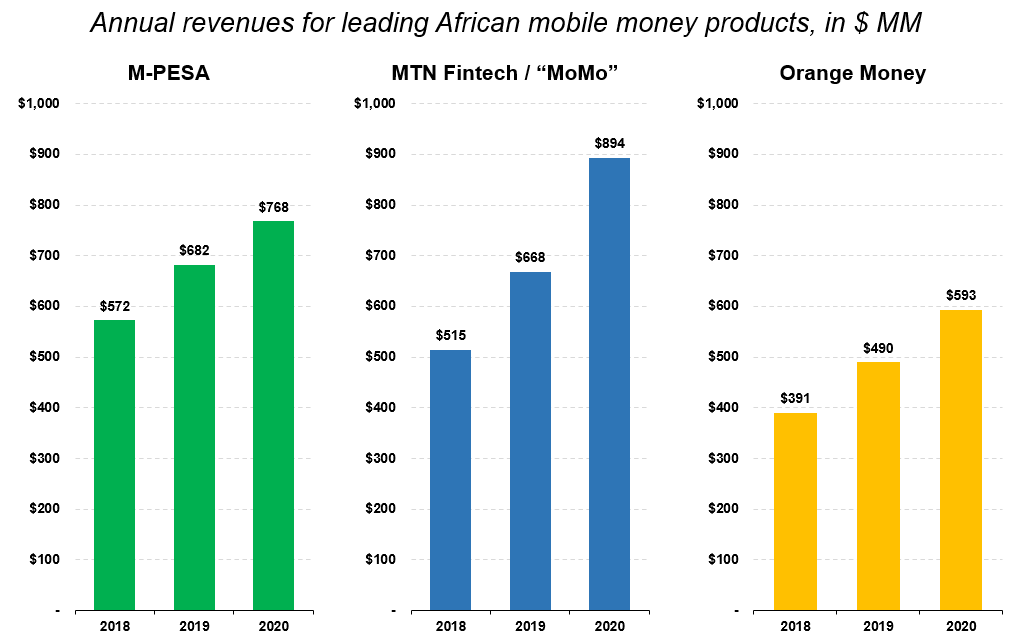

And business is booming. In 2020, MTN’s fintech arm, one of Africa's leading mobile money providers, alone generated more revenue than Silicon Valley software darling Snowflake.

The incentives are aligned. Billions of users will be onboarded to mobile money products.

Stablecoin-powered Savings

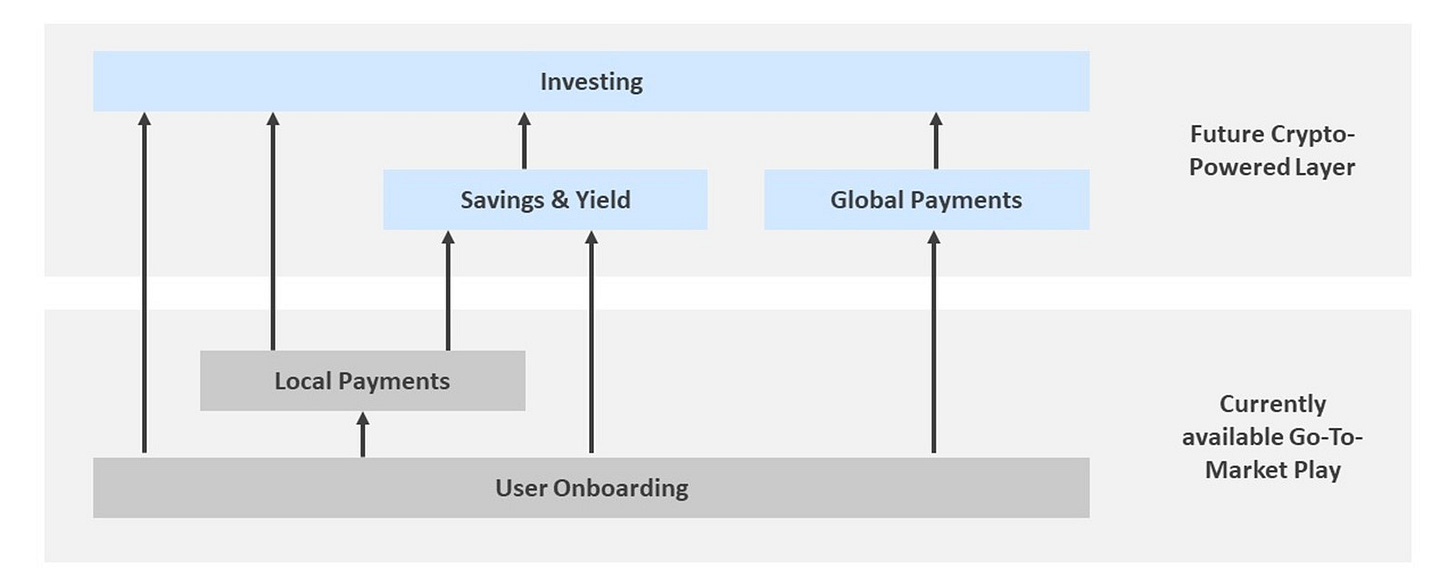

Today, leading financial inclusion players like Wave, Tigo and M-Pesa mainly provide P2P Transfers, Deposits/Withdrawals and Remittances. The financial inclusion of the billions of new users will not end here. Next, a new layer will evolve on top of this onboarding infrastructure layer to enable savings and investments.

And this is where crypto comes into play. Many users in emerging markets would prefer to save in US dollars rather than volatile, high-inflation local fiat currencies. Stablecoins can facilitate this need on scale while leveraging the DeFi advantages named in the introduction.

This value proposition is also sought after by an additional 2-3b underbanked individuals in regions like LatAm and SEA who can transfer funds but lack access to inflation hedges.

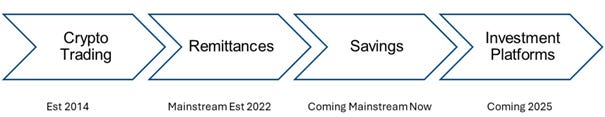

Since its inception in 2014, stablecoins have evolved considerably, expanding into remittances, and becoming the 21st largest holder of US treasuries in the process. We may be about to witness the next step-function adoption driver – savings in stablecoin finance.

Let’s examine how it started and how the evolution will proceed.

Stablecoins started as a funding currency for crypto trading and a near-instantaneous way to move fiat between trading venues. In response to the Mount Gox hack in 2014 major banks started closing accounts of crypto exchanges. Following these wind-downs, there was a back-and-forth of accounts being opened and closed again in new jurisdictions like Taiwan - an immense pain for exchanges. Tether stepped into this void and bridged fiat into crypto, so exchanges did not necessarily require banking relationships any longer. Some centralized exchanges still have no bank account.

Crypto trading has been the primary use case of stablecoins ever since. Nearly all of the most liquid trading pairs involve stablecoins; most are based on USDT.

Over the past years, the increased performance of Ethereum scaling solutions and integrated blockchains like Solana has led to the exploration of other stablecoin-powered financial primitives, with USDC/USDT remittances leading the charge.

Remittances are a $800 billion market and one of the biggest drivers of GDP in some lower-income countries. Sending remittances currently costs ~6.2 percent on average - stablecoins will decrease it to a negligible amount.

The rise of stablecoin remittances now opens the door for exploring the next logical primitives. Enter the paradigm of stablecoin-powered savings.

Crypto as an industry has repeatedly been speedrunning the lessons of traditional finance. The long path from spot trading to complex derivatives in traditional markets was replicated and re-engineered in crypto in record time. Within DeFi, TradFi primitives like yield curves, rehypothecation, and term structures are being reimagined and reimplemented.

I believe that Stablecoin Finance will continue this trend. Stablecoins' non-crypto adoption will trickle down from remittances to savings and investment platforms. Just how remittances led to stablecoin payments, non-crypto native users will soon lend and borrow on-chain due to stablecoin savings.

Entering Open Finance

Once mass consumers save in stablecoins, the journey is set to continue. Currencies will already be traded and stored on open ledgers. Interoperable, programmable, and composable units of value like stocks, bonds, and real estate will follow suit. Stablecoin-first investment platforms are set to become a substantial part of the financial system within three to five years.

Open finance could give entrepreneurs cheap and convenient access to financial primitives that can instantly reach most of their country’s population. It is a global open innovation ecosystem.

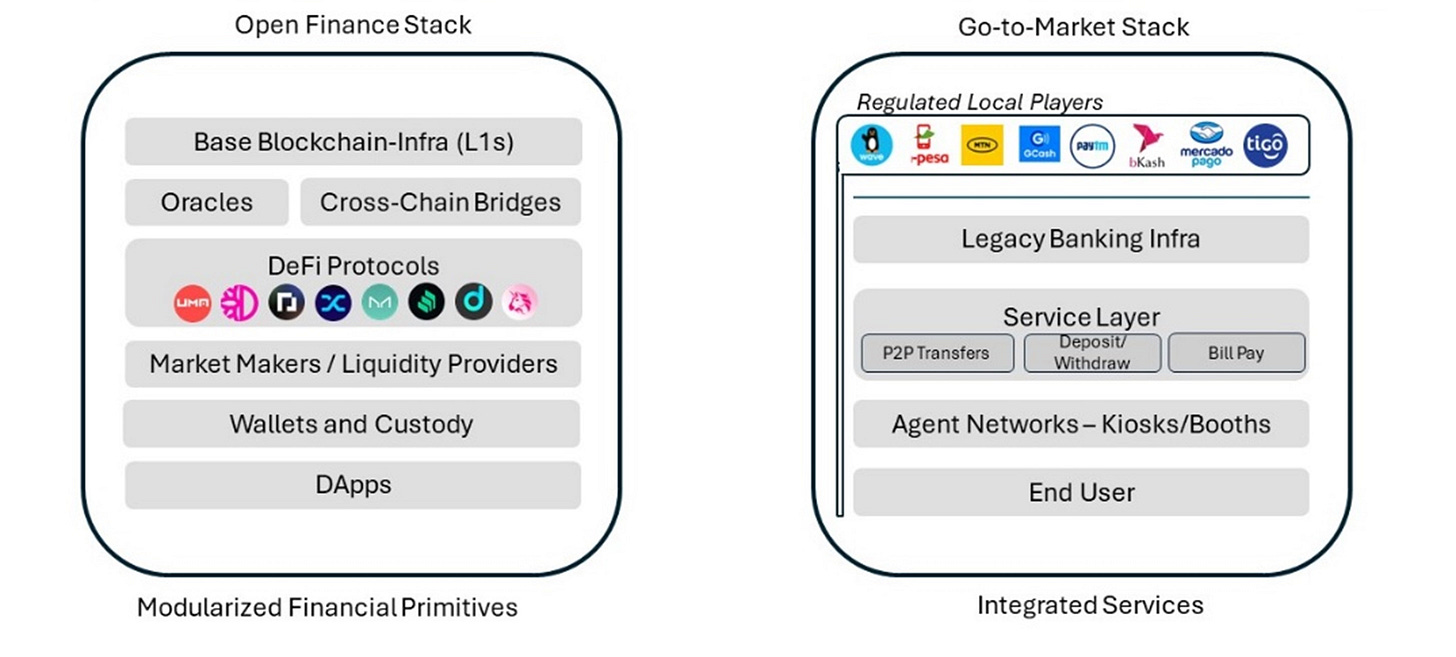

And it already exists today. Protocols like UMA can provide synthetic exposure to the S&P 500, and OpenEden offers direct access to US Treasury Bills. Projects like Ethena enable investments in sophisticated delta-neutral strategy financial instruments. In some areas, those opportunities already leapfrog the options of retail users in developed economies. For emerging markets, they constitute a zero-to-one game changer.

Paired with the benefits of DeFi described in the introduction, it is easy to see why Open Finance is predestined to become the next layer in the emerging market finance stack and eventually the next paradigm of finance globally.

For emerging markets to transition directly into the new era of finance, the open finance stack and go-to-market players will have to establish touchpoints to enable a smooth onboarding for users.

There have been first efforts to integrate the two. For instance, Opera Minipay offers USD-pegged stablecoins and yield earnings through lending and borrowing platforms to consumers in Nigeria, Ghana, and Kenya. Within five months after its launch in 2023 it crossed 1 million users. Other examples include crypto exchanges like BitVale and CoinCola allowing users to buy Bitcoin with mobile money.

First steps are being taken, but the go-to-market and open finance stack remain separated in the bigger picture.

Bridging into Open Finance

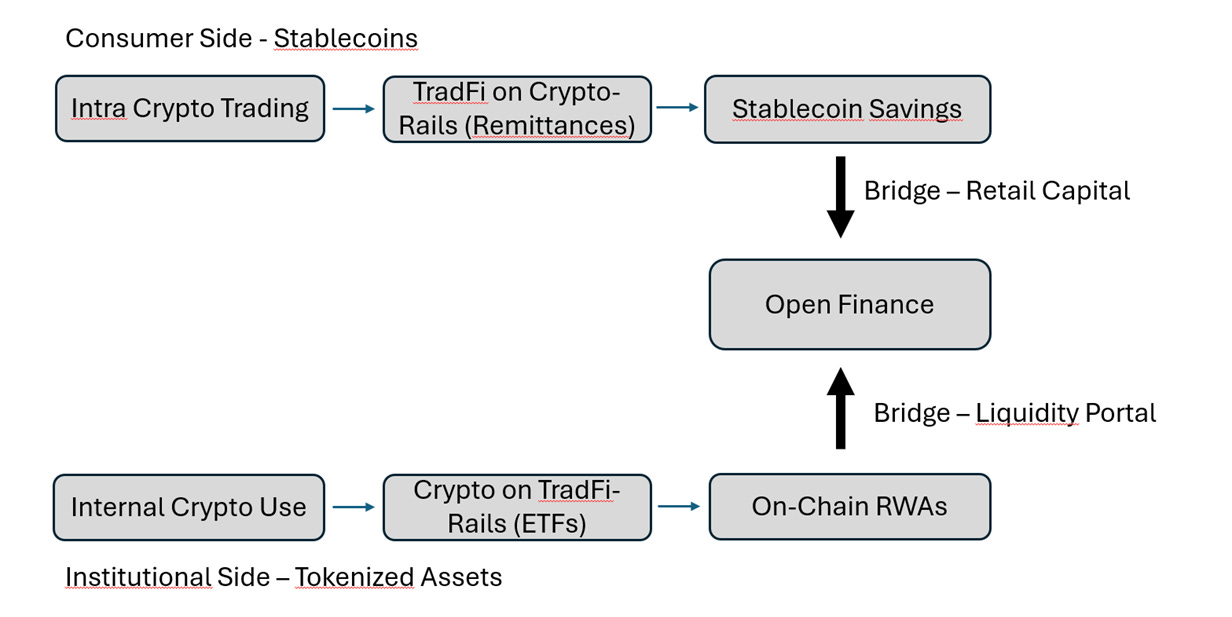

Stablecoin-powered savings will serve as the bridge for consumers into Open Finance.

There is a common pattern in the tech industry of successful consumer services being the big unlock for further businesses. As you get into the lives of millions of consumers, the business side becomes easier. Facebook Ads, Amazon Web Services and Google Maps are premier examples of this.

As stablecoins will emerge as the savings method of choice for millions – or billions – of end-users, they will unlock a new layer on top of them. Bridging into Open Finance.

The institutional side also has a Bridge into Open Finance – The Liquidity Portal. Players like Ondo Finance bring real-world assets (RWAs) on-chain, and BlackRock entered the space with a tokenized fund in March 2024. The liquidity portal into the new era of finance is broadening.

Enormous opportunities exist around both of these bridges. They’ll be to Open Finance what Wormhole is to the Multichain blockchain ecosystem – an integral part of infrastructure.

Three-step Plan with Step-Function Tailwinds

Summing up to this point, the thesis consists of two main elements: i) Within two years billions of users in emerging markets will use Stablecoins for savings and yield generation, and ii) this will constitute the iPhone moment for Open Finance.

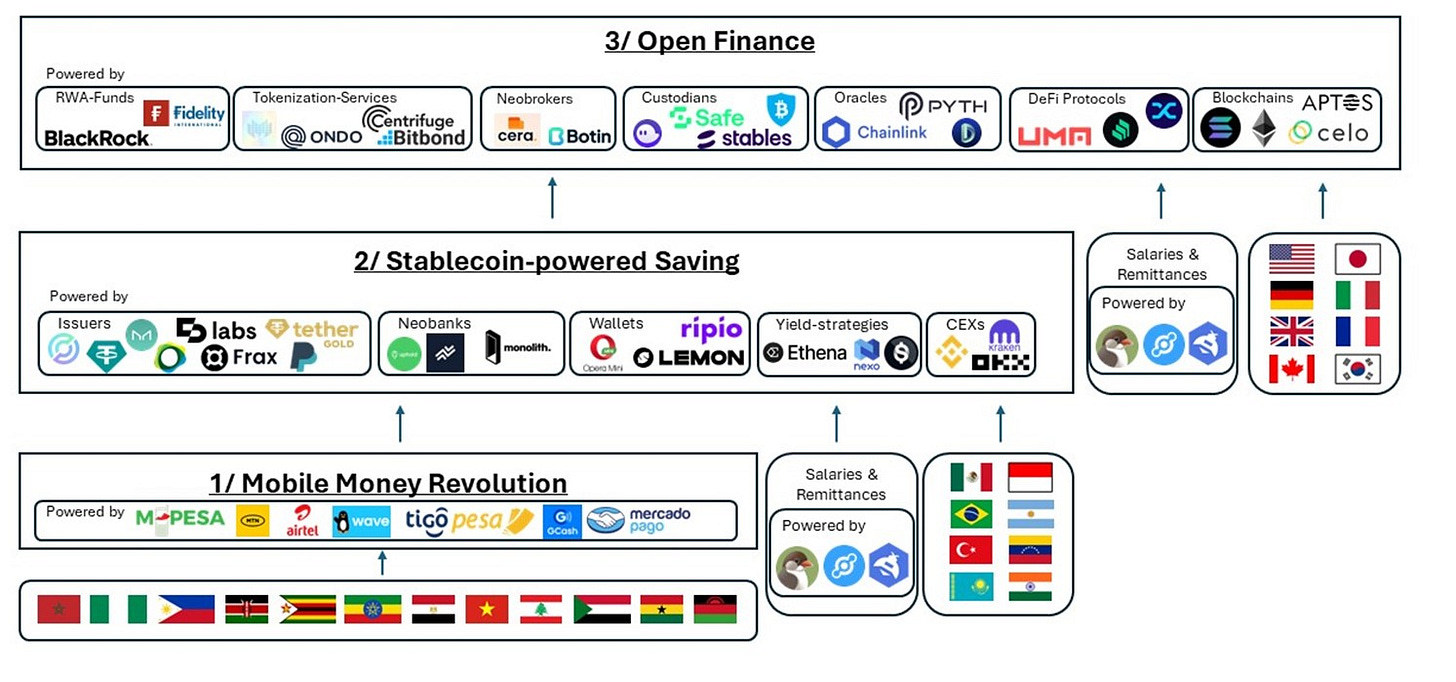

The process can be broken down into a three-step plan. Steps one and two will start hyper-localized in areas where populations suffer under the current financial system. Over time, more regions will join the wave.

This is nothing new. Did you know that you could pay for a cab ride with your phone in Nairobi, Kenya, years before you could in New York City? It was possible due to mobile money. Today, since the advent of Apple Pay, Uber, DoorDash, and the beloved Starbucks App, Americans have become used to paying with mobile phones. Tokenized Currencies, Stocks, Bonds, and other products will follow a similar pattern.

And there is another step-function adoption driver we’ve not discussed yet. More users will move on-chain without onboarding money themselves. They get paid on-chain - a third bridge into open finance. Currently, you first have to create your account at a centralized exchange like Binance, then you have to send money to the exchange, afterwards you have to create a wallet, and finally you have to send the crypto to your wallet. Roughly 100 million users completed this process.

Stablecoin-first Neobanks and other players will drastically abstract complexity. Billions of individuals who have financial pain points will go through this simplified process.

Yet, getting paid on-chain remains the lowest friction option for being onboarded into open finance. For instance, users can get paid for completing tasks on Bountycaster, driving around with Hivemapper, renting out GPUs with Render Network, and many more exciting use cases. They can also receive international remittances or transfers via Telegram. Over the long run, on-chain payments could become as significant a catalyst for adoption as stablecoin-powered financial inclusion.

Those newly onboarded users will natively turn to stablecoin-powered saving and the open finance stack.

Why now

This thesis opposes the current crypto narrative of “only one more infra cycle,” and pioneers of financial inclusion, like Wave, regard the crypto and financial inclusion narrative mainly as a case of “if all you have is a hammer, everything looks like a Nail.”

For instance, Ben Kuhn, the former CTO of Wave, argues that crypto doesn’t address the hard parts of financial inclusion like building trust, establishing local agent networks or facilitating cash on/off-ramps. And he is right. For the typical Wave user, a Senegalese fisherman who gets paid $10 per day via Wave, stablecoin-powered transactions make little sense for now. The on-the-ground heavy lifting has to be done locally through agent networks. Crypto offerings will not compete in the initial onboarding but will provide the layer on top.

Stablecoin-powered saving has not taken off earlier because we i) did not have the necessary crypto infrastructure and ii) offerings are too crypto-native and high friction. Additionally, some markets are being created as of now.

Over the past few years, we have seen quantum leaps in crypto technical infrastructure through

Increased performance of Blockchains and Scaling Technologies like ZK Rollups

Social Recovery-, Multisignature- and Web wallets

While services remain very crypto-native centered, the market pull is enormous and growing through

Step function changes in access to digital payments in emerging markets

More users moving on-chain without onboarding capital themselves

On-chain RWA funds becoming mainstream through players like BlackRock

Stablecoin-powered saving is ready for mass adoption, and it shows. In Latin America, more than a third of consumers already use stablecoins to make everyday purchases. Other regions will follow soon.

Dinero Firme – LatAm and Africa leading the Charge

Latin America backs the thesis with data and highlights that centralized institutions will enable the transition to open finance. Nearly 70 percent of consumers in Latin America and the Caribbean said they would feel more comfortable investing and transacting in crypto if there was a trusted organization in the middle.

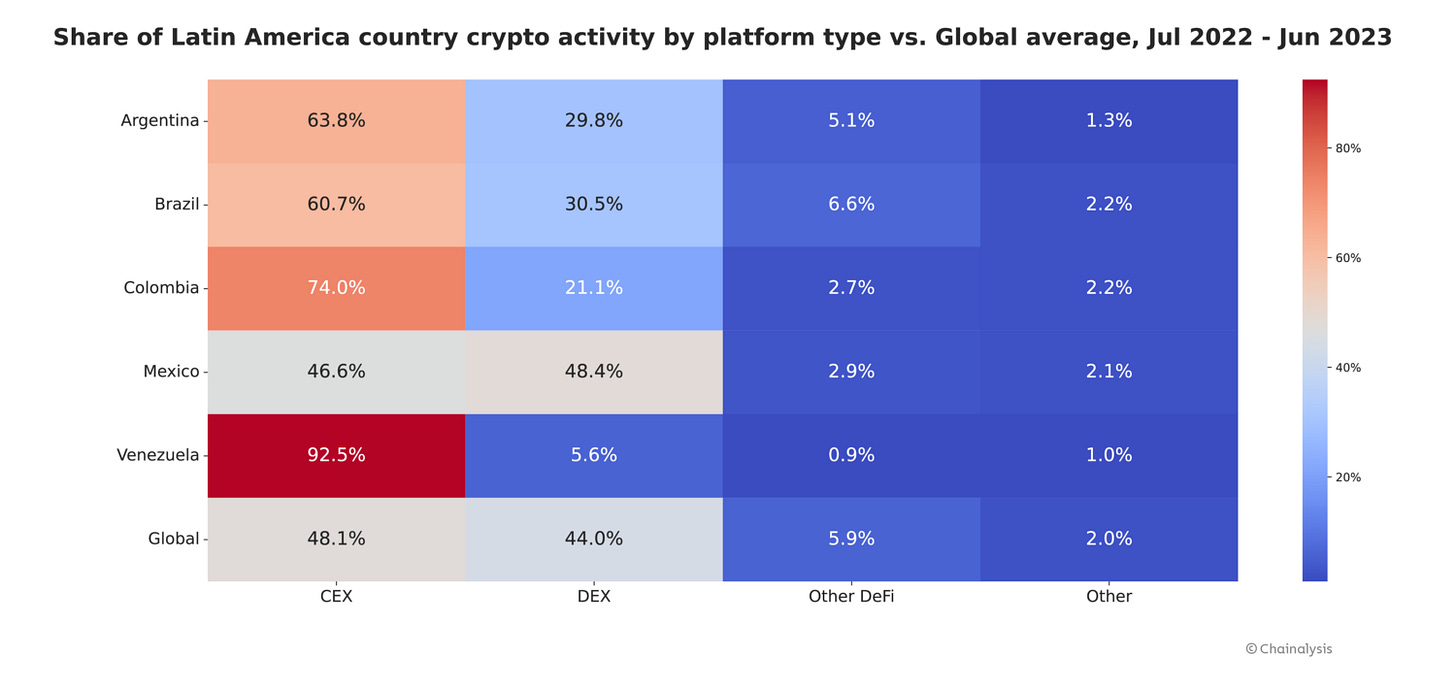

To date, no large-scale Stablecoin-first Neobanks exist, and Latin Americans have found a workaround. They use CEXs like Binance and Lemon Cash. As a result, Latin America shows the highest preference for centralized exchanges of any region globally.

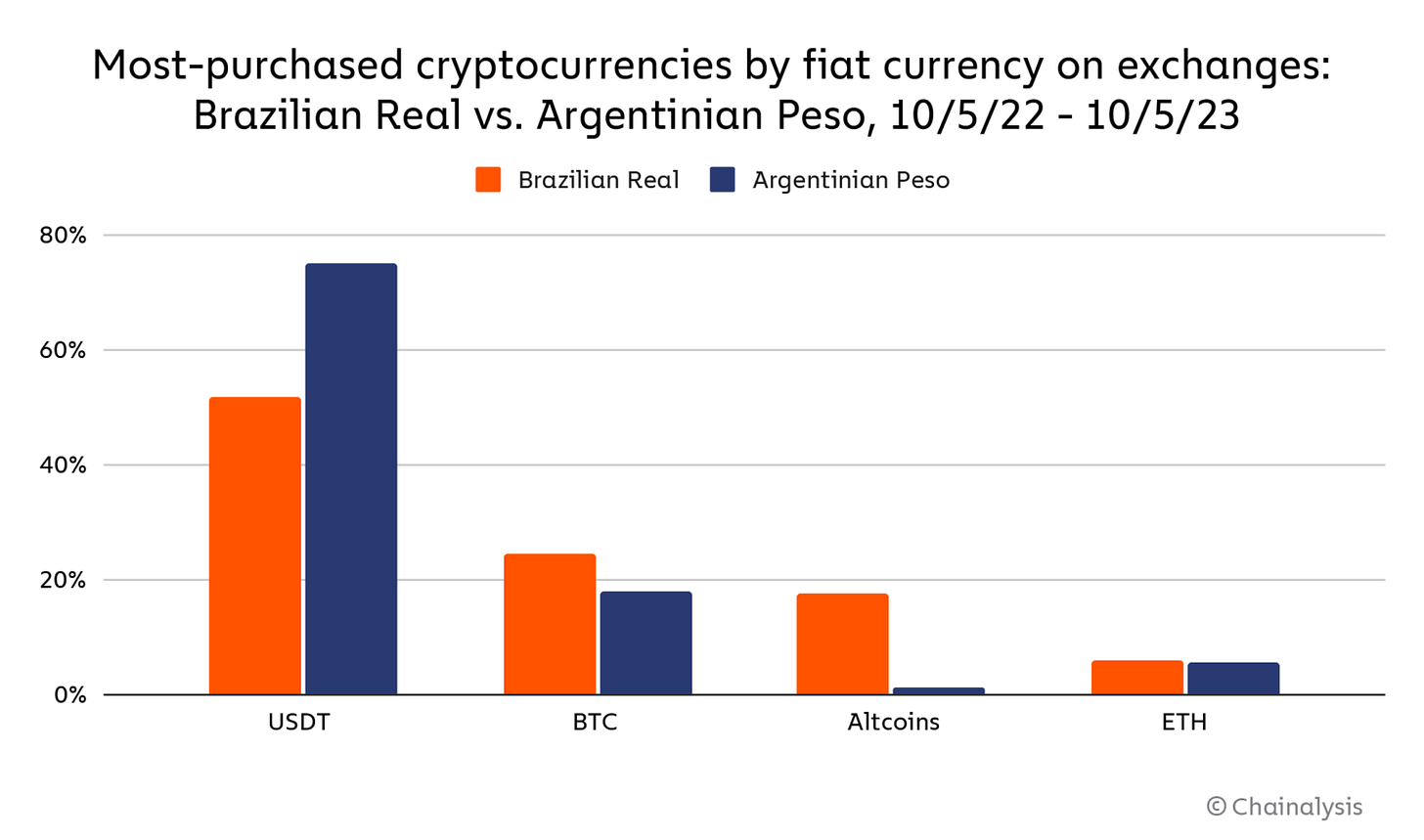

Consumers use them predominantly to buy stablecoins. CEXs serve as de facto stablecoin-first Neobanks. In countries like Argentina, over 70 percent of the trading volume flows into USDT.

As a result, local CEXs like Argentina-based Lemon Cash have started issuing debit cards that allow users to draw on their crypto accounts to make purchases at any card-accepting retailer - upon swiping the card, crypto is instantly sold from the user’s account, and the business receives payment in the local currency. It has proven a winning model; 2 million of roughly 5 million active crypto users in Argentina use Lemon. In the backend, Lemon users earn yield through Aave – this is what mass adoption will look like.

High-level Value Capture

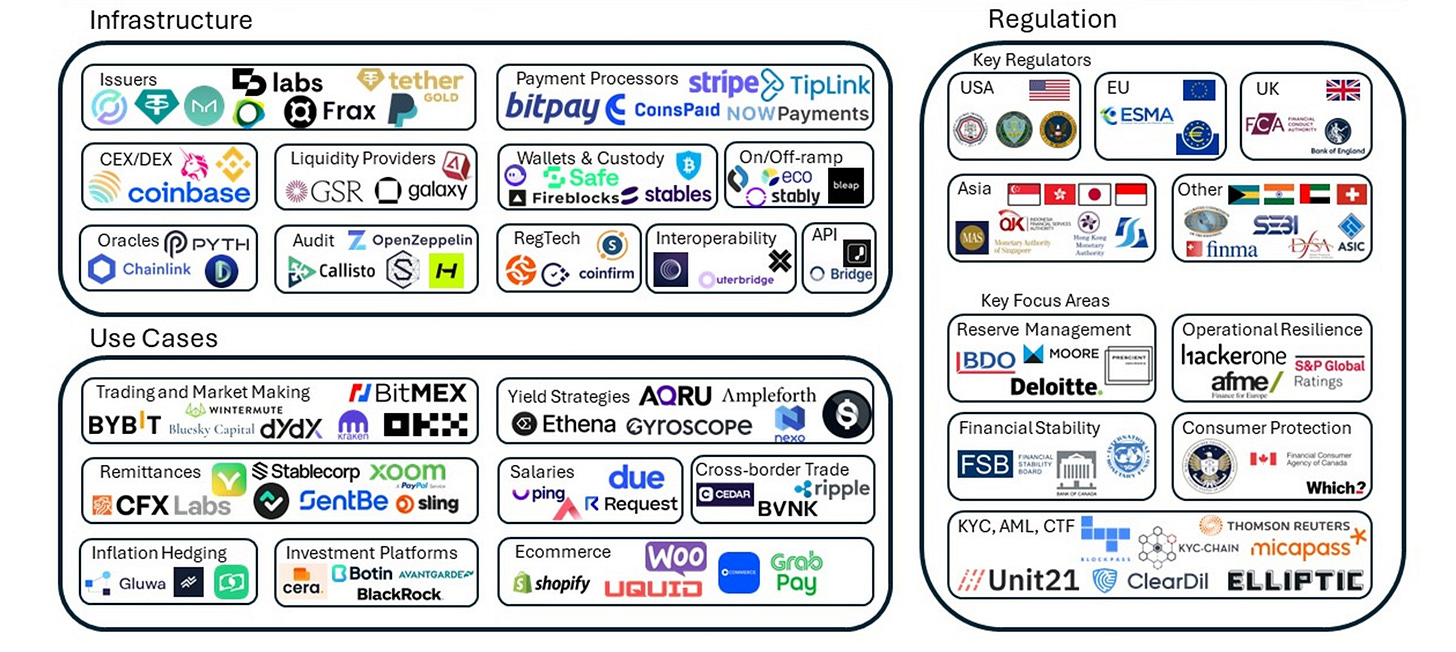

My thesis offers numerous investment opportunities along the value chain. I foresee value capture will accrue at i) the underlying ledgers settling the transactions, ii) the Open Finance stack, and iii) the Bridges into the ecosystem.

Let’s touch on those three and then further explore the stablecoin value stack.

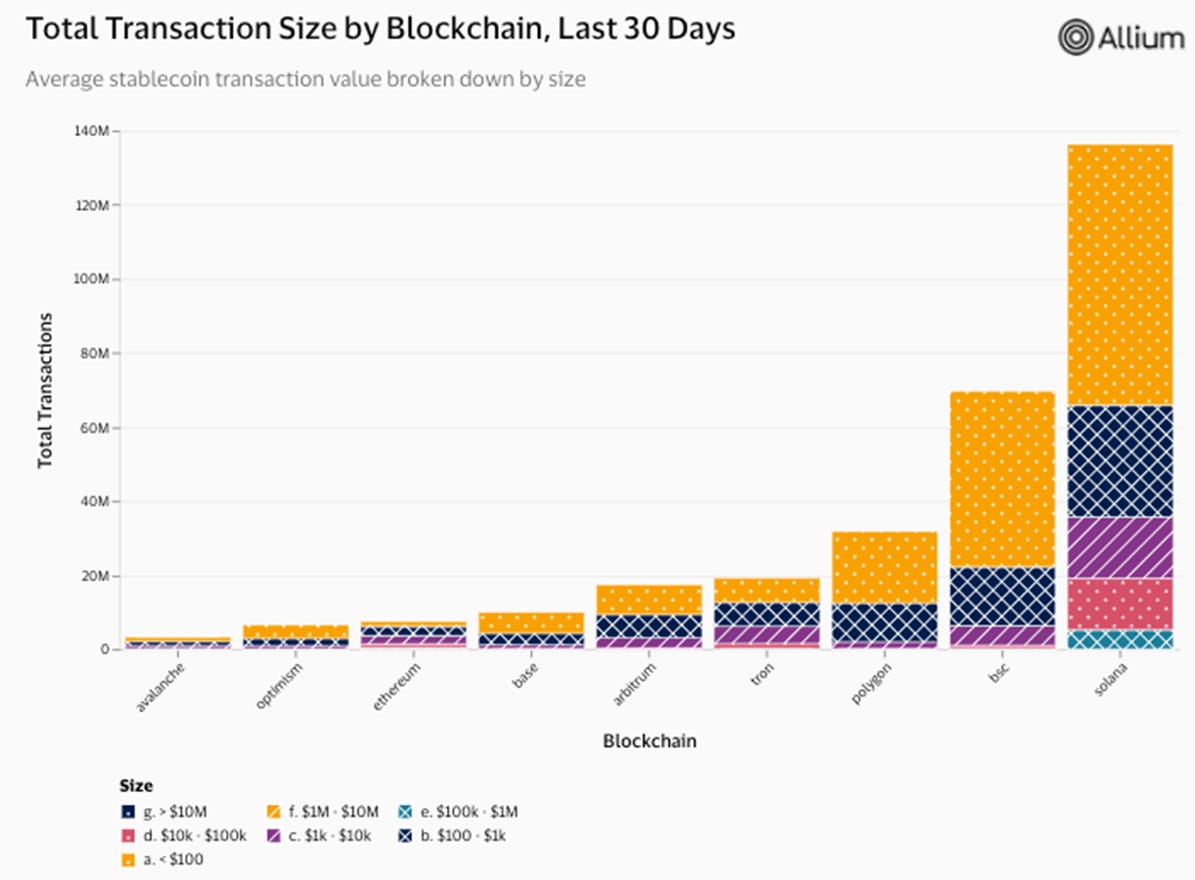

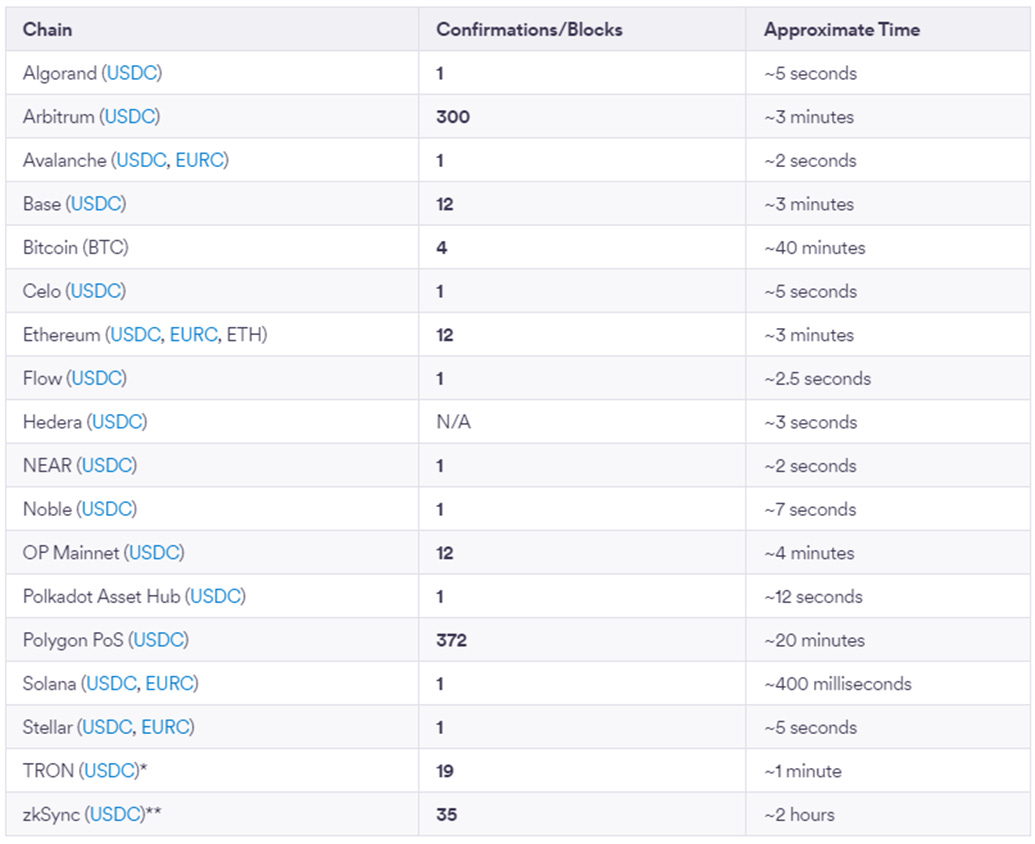

Blockchains: Solana is predestined to enable stablecoin-powered transactions and savings as it offers the fastest settling times. With 400 milliseconds, it is by far the fastest way to transfer USDC. Visa is expanding settlement capabilities on Solana and category-leading startups like Sphere, the “operating system for stablecoins,” are building on the chain. Following DePIN, stablecoin finance will be the next mass adoption use case on Solana-rails.

As users will not interact with the chain, you could imagine a model where 80 percent of funds are held on Ethereum for security purposes, and 20 percent are available on Solana or other fast, affordable chains like Tron or L2s to settle transactions. The MEV will mainly accrue on Solana as the transaction layer.

Open Finance: I’m particularly excited about protocols modularizing financial primitives without marketing to end-customers, providing customer service, or dealing with local laws.

RWA-Bridges: The RWA-bridge also offers many exciting opportunities. Companies like Securitize linking up with BlackRock and Tether moving into the space are a testament to the industry's bright future. The winners are yet to be determined – I’m especially looking forward to seeing more innovations on the regulatory and technical front.

This essay will continue to focus on investment opportunities in the stablecoin finance value stack. The stablecoin flywheel is powered by the compounding of infrastructure, use cases, and regulation.

I see great opportunities throughout the ecosystem, which can also be structured in three layers. Issuers – Middlewear Infra – Fintechs.

Let’s explore five opportunities set to profit disproportionately from the thesis.

Next Gen Issuers Funding on-chain Stock Exchanges

To date, the major stablecoin issuers can be counted on one hand. USDT and USDC hold roughly 90 percent of the market share. Tether is the world’s most profitable company with $61m profit per employee.

The prevailing narrative is that the moat of USDT and USDC lies in their network effects, regulatory compliance, and deep liquidity. While those factors are undoubtedly important, they are likely not decisive. The real moat is that the largest crypto trading pairs are denominated in USDT. 31 of the 50 most liquid crypto trading pairs use Tethers stablecoin. Billions of USDT are locked in trading venues.

This thesis is supported by the fact that Tether does not have to share its net interest margin, while USDC offers a yield of 5.1 percent on Coinbase. Crypto exchanges provide Tether its moat by using USDT as the funding currency for crypto trading.

According to the stablecoins bridging into open finance thesis, we’ll soon also trade stocks, bonds, and other assets on-chain. Crypto Neobrokers and DEXs will facilitate trades. The on-chain trading volume of these assets could quickly outgrow crypto trading volume even if only a tiny percentage of global trading is facilitated on-chain. The New York Stock Exchange alone has a total market cap of $26.9t, while the total crypto market cap sits at $2.3t.

A funding currency for those pairs will emerge, and it may very well not be USDT but another stablecoin that aligns incentives with the Neobrokers. Ethena attempts to realign incentives with CEXs through USDe, which benefits exchanges in multiple ways, and is quite successful with its approach.

Stablecoin-First Neobrokers are about to emerge in the near future. The next Gen Issuers facilitating trading pairs like SPY/USD?, AAPL/USD? and TSLA/USD? will emerge with them. They are poised to overshadow today's most profitable company globally by orders of magnitude.

Investment Stablecoins

So far, stablecoins are segmented according to their end-consumer. USDC targets the pragmatist in Argentina, USDe the Milady Maker crypto-native - airdropping holders 3% of the $ENA distribution.

As the market matures, we’ll segment by risk profiles instead. Users will want to earn yield on a portion of their holdings. RWA-backed and crypto-native Investment Stablecoins have the value proposition of providing yield to users while abstracting complexity compared to traditional investment pathways.

They can also add resilience by diversifying issuers and jurisdictions while remaining comparatively capital-efficient. If they are DAO-governed, such stablecoins could combine enough robustness, censorship resistance, scale, and economic practicality to satisfy the needs of many real-world crypto users.

The timing for such solutions to scale might be now. In this cycle, the stablecoin finance macro trend could merge with an intra-crypto interest rate market paradigm.

Let’s embark on a short excursion into the emerging crypto interest rate market.

In traditional finance, the interest rate market is enormous - even larger than other key parts of the financial system, like the FX market. The global bond market was valued at approximately $123.5 trillion in late 2020, and the notional value of the Interest Rate Derivatives Market was $495 trillion.

Before the Ethereum Merge in September 2022, there was no large-scale, crypto-native, yield-earning asset in the crypto ecosystem. ETH staking is a game changer. An ecosystem will evolve around it, fast-tracking the understanding of traditional finance interest market lessons.

Eigenlayer, one of the hottest projects of this cycle so far, is building on this primitive and creating its own innovation ecosystem. So do projects like Ethena, EtherFi, Pendle, and many more. Primitives like Eurodollar futures - the most liquid exchange-traded contracts in the world when measured in terms of open interest - will be reimagined in crypto.

Paired with the import of yield-bearing TradFi assets like bonds into the on-chain ecosystem, there exists room for many new stablecoin-branded investment products. However, the final categorization of these assets will have to be reshaped over time, as they differ widely from traditional stablecoins like USDC.

With Flatcoins emerging as a new category and the rise of Ethena’s USDe, I’m excited about teams pioneering new solutions in the space.

Payment Processors Integration

The issuing side of payments is opaque and hard to implement. It's currently putting breaks on the implementation of novel fintech ideas. This issue is particularly significant in traditional financial technology, especially when attempting to integrate multiple payment processors simultaneously.

Revolut, Monzo, and others switched from external payment processors to building in-house ones. Some companies kept a "dual system" while they were transitioning. These migrations are costly and hard to execute correctly.

Addressing this significant issue is crucial for traditional financial technology firms and crypto-focused card issuers building products on stablecoin rails. Anticipating the rise of crypto Neobanks, this pain point is expected to grow drastically.

Companies like Pai are in the early stages of exploring new solutions.

Stablecoin-First DeFi Neobanks

Most wallet products have been designed for speculators and crypto-natives, while almost none have been designed to provide the perfect onboarding flow for users in emerging markets who want to save in US dollars.

As discussed earlier, local CEXs like Lemon Cash have been the closest to providing a seamless onboarding flow and have been very successful with it. It serves as a testament to the product-market-fit of stablecoin-powered savings but is still far from a mass market optimized solution.

Consumers usually think of their cash and investment assets as two separate categories. Mixing them causes brand confusion. There is room to build stablecoin-first Neobanks with a strong geofocus.

I look forward to seeing more startups like Littio in Latin America or Spring in Africa.

Stablecoin-First Neobrokers

Stablecoin-first Neobrokers will use stablecoins as the primary medium of exchange to streamline the trading of stocks, bonds, and other traditional assets. They’ll provide faster settlement times, reduced costs, increased accessibility to global markets, and can offer integrations to internet publishers like X and Telegram.

Despite their potential, Stablecoin-first Neobrokers face significant challenges, particularly in the realm of regulation. Bittrex facilitated the trading of tokenized stocks such as Apple, Tesla, and Amazon on its digital asset exchange but had to wind down after being charged by the SEC for operating an unregistered securities exchange. Similarly, Binance ceased support for stock tokens in 2021 due to regulatory concerns.

While the holy grail of a fully-collateralized stock token trading platform analogous to Circle in the currency space may be challenging in the current regulatory environment, Stablecoins and the RWA-megatrend of 2024 gives tailwinds for new attempts to facilitate the Nasdaq on-chain.

Tokenized treasury products grew 782% in 2023, and Blackrock launched its first on-chain fund in 2024. Equities could follow the blueprint structure of Tokenized Treasuries shortly.

Since 2021, Switzerland lets tokenized securities trade on a blockchain with the same legal standing as traditional assets. Its progressive stance might serve as the regulatory backbone for tokenized equities' next wave of innovation.

There exists lots of room for operational innovations. Similar to Stablecoins, tradfi-native (e.g., USDC) and crypto-native (e.g., USDe) alternatives are feasible with respective tradeoffs.

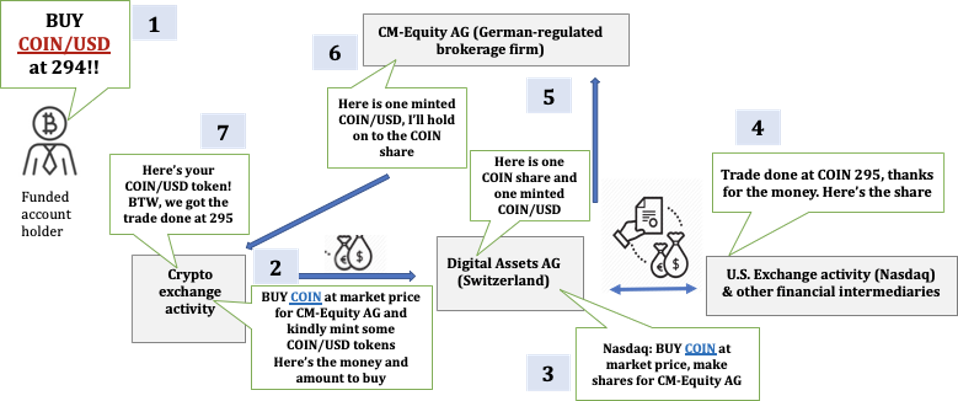

TradFi-native: Various crypto exchanges, including FTX, leveraged the offerings of CM-Equity AG and Digital Assets AG to tokenize equities. It was a first TradFi-native, fully collateralized model. CM-Equity could honor a redemption of the spot token for the actual share of stock.

This model is highly scalable but has double-sided counterparty risk as the brokerage firms or exchanges may halt operations. The tokenized stocks a client may hold could be unreachable or unusable outside of the issuing party, even if written to a blockchain. A semi-transparent separation of duties by the exchange, the shares holder, and the company minting the new token.

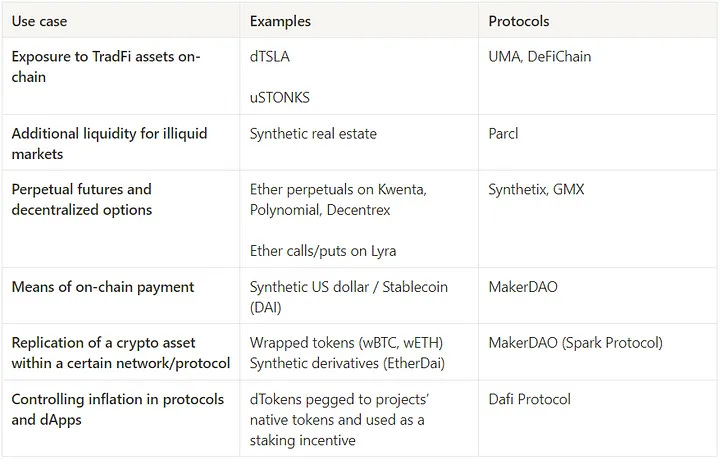

Crypto-native: With more users saving in stablecoins, the crypto-native alternative may become increasingly attractive. Open Finance Protocols like UMA and DeFiChain enable users to create their own synthetic assets – digital tokens representing and tracking the price of any real-life asset.

Stablecoin-first Neobrokers could leverage those synthetic assets and make them accessible to emerging market populations. Billions of potential users lack access to financial instruments and will start saving in Stablecoins.

The risks associated with holding assets originating from foreign countries while residing in a country with highly restricted access to such assets may outweigh the risk of trading those assets on-chain and exposing funds to potential smart contract breaches.

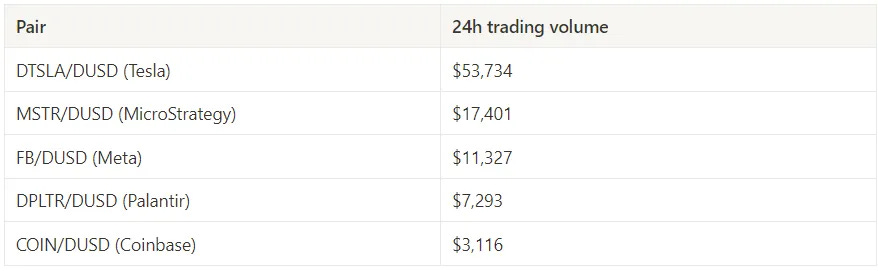

DefiChain stands out as one of the few platforms that introduced on-chain trading of stocks in 2021. The trading volumes remain modest - especially compared to synthetic perp futures - thus far, but the infrastructure is ready to scale up.

Cera is pioneering this new investing paradigm. It allows users in almost every country to trade US stocks with stablecoins. It supports crypto-native on-ramps from Ethereum, Polygon, and the Binance smart chain.

Historically, building in regulatory grey areas has led to great startup successes like AirBnB, Tesla, DraftKings, and Uber. Unclear regulations can deter incumbents (like Binance) and empower risk-taking entrepreneurs. Crypto-powered Neobrokers - whether crypto- or TradFi-native - are set to be the next great Regulatory Entrepreneurship success story. Let me know if you’re one of the people writing it.

If you’re building any of the ideas above, whether as an off-chain service or on-chain protocol, please reach out. I’d be excited to get to know you.